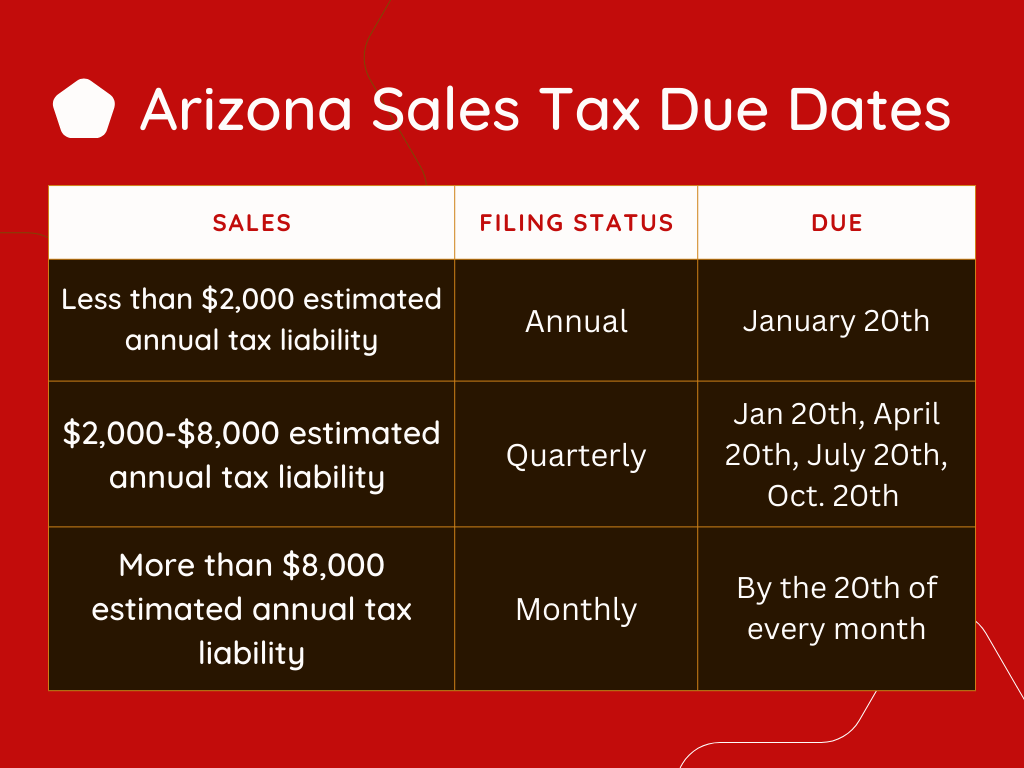

Arizona Sales Tax Return Due Date . Please remember that a tpt return must be submitted. Calendar of arizona sales tax filing dates. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Below, we've grouped arizona tpt filing due. What are the arizona sales tax due dates? Taxpayers can file now and schedule payments up until the deadline. Quarterly return due date annual return due date. The arizona department of revenue (ador) reminds. For monthly filers, returns are. Depending on the volume of sales taxes you collect and the status of your sales tax account. The following links will help filers determine filing and payment deadlines. Electronic returns must be submitted by the last weekday of the month following the tax period. Arizona sales tax due dates vary based on filing frequency. Paper return received by ador.

from www.salestaxsolutions.us

Below, we've grouped arizona tpt filing due. What are the arizona sales tax due dates? Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Calendar of arizona sales tax filing dates. The arizona department of revenue (ador) reminds. For monthly filers, returns are. Taxpayers can file now and schedule payments up until the deadline. Quarterly return due date annual return due date. Paper return received by ador. The following links will help filers determine filing and payment deadlines.

Arizona Sales Tax Guide SalesTaxSolutions.US

Arizona Sales Tax Return Due Date Depending on the volume of sales taxes you collect and the status of your sales tax account. Arizona sales tax due dates vary based on filing frequency. The following links will help filers determine filing and payment deadlines. Taxpayers can file now and schedule payments up until the deadline. Calendar of arizona sales tax filing dates. Please remember that a tpt return must be submitted. Quarterly return due date annual return due date. What are the arizona sales tax due dates? For monthly filers, returns are. Depending on the volume of sales taxes you collect and the status of your sales tax account. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Electronic returns must be submitted by the last weekday of the month following the tax period. Paper return received by ador. The arizona department of revenue (ador) reminds. Below, we've grouped arizona tpt filing due.

From patricewaileen.pages.dev

Pa Quarterly Sales Tax Due Dates 2024 Tedda Gabriell Arizona Sales Tax Return Due Date The arizona department of revenue (ador) reminds. What are the arizona sales tax due dates? Taxpayers can file now and schedule payments up until the deadline. Depending on the volume of sales taxes you collect and the status of your sales tax account. Paper return received by ador. For monthly filers, returns are. Arizona sales tax due dates vary based. Arizona Sales Tax Return Due Date.

From www.salestaxsolutions.us

Arizona Sales Tax Guide SalesTaxSolutions.US Arizona Sales Tax Return Due Date Arizona sales tax due dates vary based on filing frequency. The following links will help filers determine filing and payment deadlines. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Quarterly return due date annual return due date. The arizona department of revenue (ador) reminds. What are the arizona sales tax due dates?. Arizona Sales Tax Return Due Date.

From adeybjerrine.pages.dev

Lainey Wilson Concert Tour 2024 Tiena Gertruda Arizona Sales Tax Return Due Date Depending on the volume of sales taxes you collect and the status of your sales tax account. Quarterly return due date annual return due date. Taxpayers can file now and schedule payments up until the deadline. Calendar of arizona sales tax filing dates. The following links will help filers determine filing and payment deadlines. Please remember that a tpt return. Arizona Sales Tax Return Due Date.

From www.semashow.com

Nevada Monthly Sales Tax Return Due Date Arizona Sales Tax Return Due Date For monthly filers, returns are. Calendar of arizona sales tax filing dates. Paper return received by ador. Arizona sales tax due dates vary based on filing frequency. Please remember that a tpt return must be submitted. The following links will help filers determine filing and payment deadlines. Below, we've grouped arizona tpt filing due. The arizona department of revenue (ador). Arizona Sales Tax Return Due Date.

From adeybjerrine.pages.dev

Air Show Europe 2024 Tiena Gertruda Arizona Sales Tax Return Due Date Taxpayers can file now and schedule payments up until the deadline. The arizona department of revenue (ador) reminds. Below, we've grouped arizona tpt filing due. For monthly filers, returns are. Quarterly return due date annual return due date. Depending on the volume of sales taxes you collect and the status of your sales tax account. Calendar of arizona sales tax. Arizona Sales Tax Return Due Date.

From literacybasics.ca

Nevada Monthly Sales Tax Return Due Date Literacy Basics Arizona Sales Tax Return Due Date For monthly filers, returns are. Calendar of arizona sales tax filing dates. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Please remember that a tpt return must be submitted. Quarterly return due date annual return due date. The arizona department of revenue (ador) reminds. Arizona sales tax due dates vary based on. Arizona Sales Tax Return Due Date.

From meggandeniz.blogspot.com

37+ Arizona State Tax Calculator MegganDeniz Arizona Sales Tax Return Due Date Arizona sales tax due dates vary based on filing frequency. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Below, we've grouped arizona tpt filing due. Depending on the volume of sales taxes you collect and the status of your sales tax account. For monthly filers, returns are. The following links will help. Arizona Sales Tax Return Due Date.

From lorryaugustina.pages.dev

When Is Maryland Tax Day 2024 Selia Cristina Arizona Sales Tax Return Due Date Paper return received by ador. Please remember that a tpt return must be submitted. Depending on the volume of sales taxes you collect and the status of your sales tax account. Below, we've grouped arizona tpt filing due. What are the arizona sales tax due dates? Taxpayers can file now and schedule payments up until the deadline. The arizona department. Arizona Sales Tax Return Due Date.

From www.formsbank.com

Sales Tax Department Form State Of Arizona printable pdf download Arizona Sales Tax Return Due Date What are the arizona sales tax due dates? Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. The arizona department of revenue (ador) reminds. Electronic returns must be submitted by the last weekday of the month following the tax period. Taxpayers can file now and schedule payments up until the deadline. The following. Arizona Sales Tax Return Due Date.

From www.dochub.com

Arizona sales tax Fill out & sign online DocHub Arizona Sales Tax Return Due Date Paper return received by ador. Depending on the volume of sales taxes you collect and the status of your sales tax account. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. The arizona department of revenue (ador) reminds. Arizona sales tax due dates vary based on filing frequency. Below, we've grouped arizona tpt. Arizona Sales Tax Return Due Date.

From tallyjennee.pages.dev

Deadline For Business Taxes 2024 Raye Valene Arizona Sales Tax Return Due Date Taxpayers can file now and schedule payments up until the deadline. Calendar of arizona sales tax filing dates. Below, we've grouped arizona tpt filing due. Paper return received by ador. Depending on the volume of sales taxes you collect and the status of your sales tax account. What are the arizona sales tax due dates? Electronic returns must be submitted. Arizona Sales Tax Return Due Date.

From stepbystepbusiness.com

Arizona Sales Tax Calculator Arizona Sales Tax Return Due Date Depending on the volume of sales taxes you collect and the status of your sales tax account. Arizona sales tax due dates vary based on filing frequency. Quarterly return due date annual return due date. The following links will help filers determine filing and payment deadlines. What are the arizona sales tax due dates? Below, we've grouped arizona tpt filing. Arizona Sales Tax Return Due Date.

From www.knau.org

Arizonans Pay Some of the Highest Sales Taxes in the Country KNAU Arizona Sales Tax Return Due Date Arizona sales tax due dates vary based on filing frequency. Paper return received by ador. Below, we've grouped arizona tpt filing due. Electronic returns must be submitted by the last weekday of the month following the tax period. What are the arizona sales tax due dates? Calendar of arizona sales tax filing dates. Aztaxes.gov allows electronic filing and payment of. Arizona Sales Tax Return Due Date.

From euniceviviyan.pages.dev

Whats The Tax Deadline 2024 Clary Cordula Arizona Sales Tax Return Due Date Paper return received by ador. Depending on the volume of sales taxes you collect and the status of your sales tax account. Quarterly return due date annual return due date. What are the arizona sales tax due dates? For monthly filers, returns are. Below, we've grouped arizona tpt filing due. Aztaxes.gov allows electronic filing and payment of transaction privilege tax. Arizona Sales Tax Return Due Date.

From www.tucsonsentinel.com

Az’s combined sales tax rate 2ndhighest in nation Arizona Sales Tax Return Due Date Electronic returns must be submitted by the last weekday of the month following the tax period. Arizona sales tax due dates vary based on filing frequency. Please remember that a tpt return must be submitted. Below, we've grouped arizona tpt filing due. For monthly filers, returns are. Taxpayers can file now and schedule payments up until the deadline. Aztaxes.gov allows. Arizona Sales Tax Return Due Date.

From www.youtube.com

Unlocking Arizona's Sales Tax Permit Your Guide to Legal Business Arizona Sales Tax Return Due Date Please remember that a tpt return must be submitted. Quarterly return due date annual return due date. Depending on the volume of sales taxes you collect and the status of your sales tax account. Below, we've grouped arizona tpt filing due. The arizona department of revenue (ador) reminds. Electronic returns must be submitted by the last weekday of the month. Arizona Sales Tax Return Due Date.

From eydielucille.pages.dev

2024 Tax Deadlines List Usa Zaria Therine Arizona Sales Tax Return Due Date Depending on the volume of sales taxes you collect and the status of your sales tax account. For monthly filers, returns are. The arizona department of revenue (ador) reminds. Please remember that a tpt return must be submitted. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. What are the arizona sales tax. Arizona Sales Tax Return Due Date.

From wcy.wat.edu.pl

Nevada Monthly Sales Tax Return Due Date Wydział Arizona Sales Tax Return Due Date Calendar of arizona sales tax filing dates. Quarterly return due date annual return due date. For monthly filers, returns are. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Paper return received by ador. Arizona sales tax due dates vary based on filing frequency. Taxpayers can file now and schedule payments up until. Arizona Sales Tax Return Due Date.